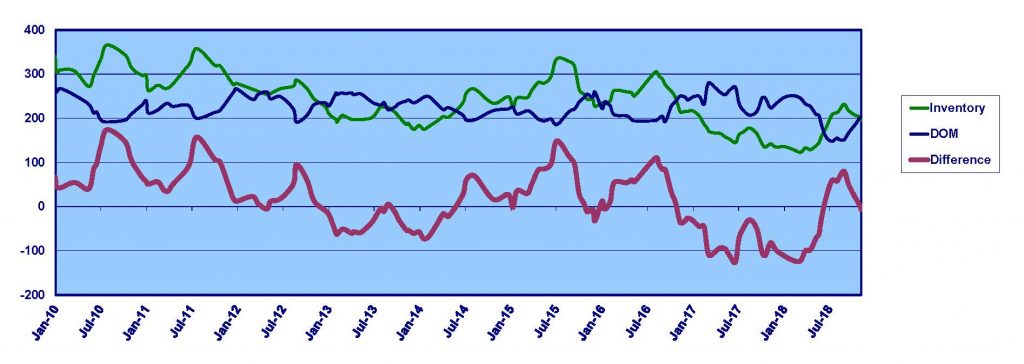

Better Get Your List Price Right: An analysis of condo sales over the last ten years shows that the average time it took a condo to sell was 75% quicker when priced right. By ‘priced right’, we mean that a property was priced in line with the market that it received an offer and went into escrow without ever having to reduce its list price.

Put another way, it took an average of 172 days to sell condos that were fishing for a higher price and had to employ at least one price reduction, versus only 42 days for condos that went into escrow without any price reductions. These is a significant difference.

Many sellers like to test the market with a listing price that is higher than what their Realtor recommends. And they are okay if the condo sits on the market for a while, because many are also making rental income at the same time. But if you need to sell your property quickly, we recommended studying recent sales of comparable properties (‘comps’) with us, noting how quickly it took them to sell, and then pricing your property appropriately.

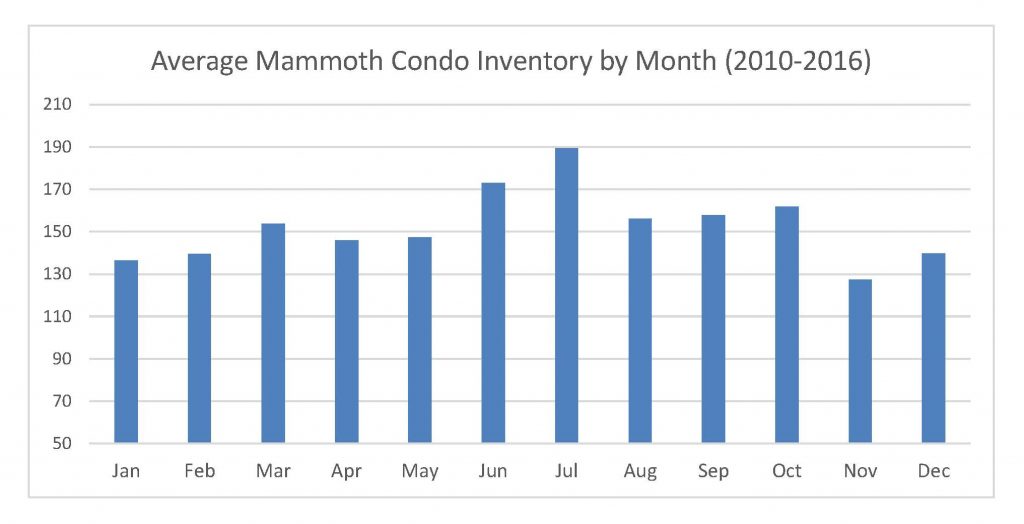

Availability: Another factor that will influence your ‘DOM’ (Days on Market) is whether your condo is available for showings. As alluded to previously, many sellers like to keep their condo available for short term rentals while it is also listed for sale. This can seriously limit the number of showings, as potential buyers are often in town during busy weekends when many condos are occupied by vacationers.

Months of Supply / Absorption Rate: One overall measurement of how quickly it takes listings to sell is called ‘Months of Supply’ or ‘Absorption Rate.’ This is the number of months it would take to sell off the entire inventory at the current pace of sales (i.e. how quickly current listings get absorbed by buyers).

Mammoth’s current condo Supply is 4.0 months. Calculation: 124 active condos for sale divided by the average of 31 condos selling per month over the last three months. Theoretically, if you listed your condo in line with the market, you could expect it to sell in about 4 months. If you choose a higher listing price, it could take longer (and require several price reductions). If you are aggressive with the price, you might expect to sell it more quickly than 4 months.

The speed record for the Mammoth condo market in the last 15 years was only 0.7 Months of Supply recorded in January 2004 (things were selling like hotcakes in that market! Remember Intrawest?). The slowest absorption rate was during September 2008 (Recession) with a Supply of 40.4 months! Can you imagine it taking 3 1/3 years to sell your condo?

Looking forward: As you can see in the graph below, the current trend is ever-so-slightly upwards. This is because there are more listings and slightly slower sales…signs of a possibly cooling market. Better get your listing price right!

Months of Supply (Current Inventory / Pace of Sales)

Homes: The current Supply for single family homes in Mammoth is 6.4 months (66 homes for sale divided by 10.3 homes selling per month). Even through some minor seasonal fluctuations, the average Supply over the last year and a half has been 6.3 months.

The current nationwide Supply for residential real estate is 6.4 months as reported by the Federal Reserve Bank. (The hottest market was 3.5 months of Supply in August 2003 and slowest was 12.2 months in Jan 2009. https://fred.stlouisfed.org/series/MSACSR)

The Extra Mile

We try to go the extra mile to get our listings to sell as quickly as possible. From providing refreshments at Realtor caravans, to turning up the heat before showings, we like doing the little things that help show our sellers’ properties in the best light. We have been known to shovel snow from walkways before showings (or remove the occasional dead animal!).

And then there are the extra things done during escrow to help get to the finish line… zipping up to the property at the drop of a hat to welcome in inspectors, contractors, appraisers, etc. We are pros at installing smoke alarms and carbon monoxide detectors to help pass inspection. We sometimes help move furniture when sellers cannot do so.

In our resort market with many absentee homeowners, we feel that it is just part of the job to be the boots on the ground and help wherever necessary to get to the close of escrow. -Dennis & Tara (Sept 2019)